Export Finance Norway has recovered from the offshore oil and gas sector crisis, with important lessons learned.

Significant exposure

When oil prices collapsed in 2014, the forerunner of Eksfin was loaded to the brink with oil and gas exposure (NOK 66 billion/€5.7 billion), mainly consisting of offshore service and drilling rig vessels. The situation deteriorated rapidly and lasted well into the COVID-19 pandemic. Vessels in the offshore service sector were particularly hard hit.

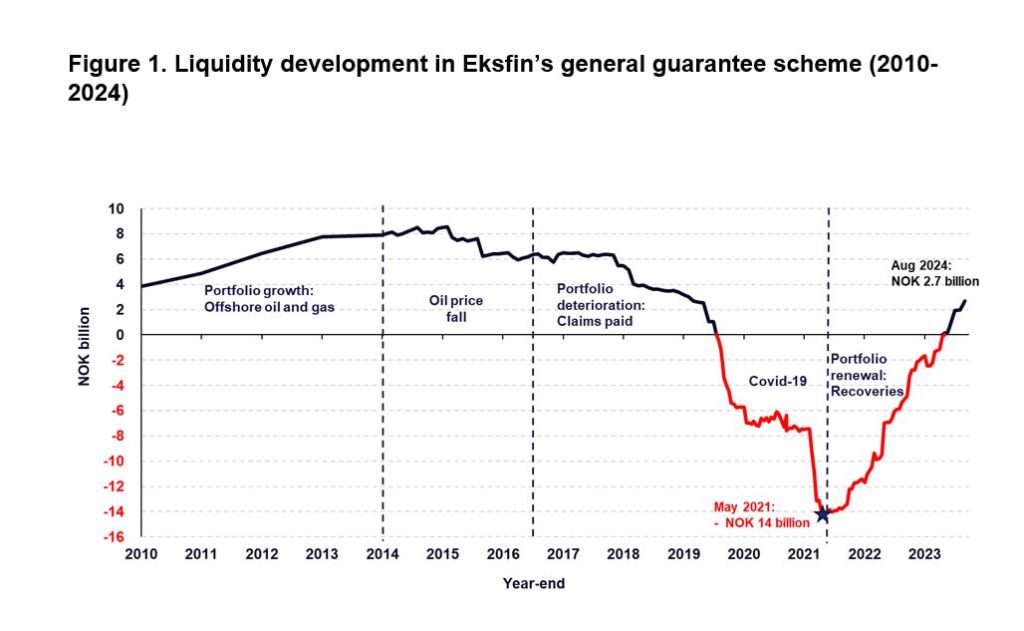

By late spring 2020, after nearly six years of restructuring debt and keeping claims paid at bay, Eksfin required additional liquidity to honour its nonperforming guarantees, which it secured via a loan from its governing authority, Norway’s Ministry of Trade and Industry.

At its peak in 2021, the loan was more than NOK 14 billion (€1.2 billion) and total commercial claims paid during the period 2014-2023 were nearly NOK 39 billion (€3.4 billion). The situation looked bleak, and it was feared that Eksfin would be unable to break even in the long run.

Fast forward to 2024: Eksfin has repaid the outstanding principal and interest on the loan, and the remaining offshore oil and gas portfolio is now, for the most part, classified as healthy (Stage 1 or 2 in IFRS terminology).

How did the situation turn around so quickly?

The successful recovery of a significant number of commercial claims, paid over a shorter period than previously predicted, has several explanations.

Eksfin has a long history of ship financing, where the crisis was concentrated. Ship financings are often supplemented by mortgages; these provide a good platform for debt restructuring and a good position in bankruptcy negotiations.

Given Norway’s significant export volume in the offshore oil and gas service sector, Eksfin knew the industry well. We saw the seriousness of this situation early on and took an active role in debt restructuring. As Eksfin is not a regulated financial institution, it can sit longer with distressed assets on its balance sheet than a bank. This provided flexibility in debt restructuring negotiations.

We were already preparing for the crisis when it hit us. The Ministry of Trade and Industry was aware of the concentration risk thanks to an open and constructive dialogue throughout the build-up of our portfolio. In light of this, a review of our Regulatory Framework was completed in 2015.

Finally, the oil price recovery and need for energy security helped to ease the situation from 2022 onward.

At Eksfin, we would argue that our successful history of recoveries in a troubled sector goes much deeper than these market and organisational factors. We were well prepared and used the limited opportunities we had wisely to “turn the ship around”.

How did we navigate the crisis?

We were already preparing for the crisis when it hit us. The Ministry of Trade and Industry was aware of the concentration risk thanks to an open and constructive dialogue throughout the build-up of our portfolio. In light of this, a review of our Regulatory Framework was completed in 2015.

The timing of the review was excellent, especially considering that one of the main changes was an amendment of the loss minimising and recovery clauses. The implicit was now made explicit. A list of possible measures was included, with the aim of ensuring that Eksfin had recourse to the same set of tools as the banks. The list was non-exhaustive and included permissions such as converting debt to equity, performing debt swaps, selling claims, contributing with new money on commercial terms, granting payment holidays, and enforcing mortgages, among others. We soon made use of all of them.

Competence and risk-sharing

For decades, our Board of Directors has exclusively been drawn from the private sector, operating with a high degree of independence. The Board’s professionalism was a major asset as we navigated the crisis.

Eksfin’s long-standing policy of risk-sharing with commercial banks was also valuable. In the transactions affected by the crisis, our participation was on the same terms and conditions as the banks, with equal ranking in securities.

In the wake of the financial crisis, Eksfin put great time and effort into professionalising our credit department and portfolio management. We strengthened in-house credit and legal competence by hiring senior professionals from banks and law firms, and through interdisciplinary teamwork.

Establishing principles and practices to minimise losses

When the market collapsed, Eksfin performed a stakeholder analysis for each case and assessed our creditor position. Eksfin often financed vessel by vessel, with a single-purpose company as the debtor. However, our creditor position would be greatly impacted by intercompany debt positions, parent company guarantees, and (lack of) restrictions on liquidity flow. Using this information, we were able to establish contingency plans.

Additionally, although we held equal ranking in securities, Eksfin’s interests and those of the commercial bank(s) were not always aligned. At the outset of the crisis, what proved to be an important principle was established: Eksfin should always take an active and constructive role in negotiations, aiming to maximise our recovery. Dedicated teams for each transaction were set, consisting of a financial expert, an industry expert, and a lawyer. A special credit committee was also established to support the dedicated teams and ensure quick decisionmaking.

Our customers were in dire need of breathing space to seek more permanent solutions. For Eksfin, this meant granting (partial) payment holidays and waiving covenants, whilst ensuring that our creditor position was maintained and, where possible, expanded to improve manoeuvrability. One way this was accomplished was including new wording in legal agreements regarding, e.g., the right to force asset sales and better enforcement rights.

Finally, facing huge potential losses, Eksfin chose to pay out to the beneficiaries of our guarantees as early as possible, increasing claims paid dramatically. The rationale behind this policy was to avoid financing future losses. Eksfin became a lender, and as liquidity needs increased, a loan was granted by the Ministry of Trade and Industry.

Lessons from a crisis

Despite being prepared for a crisis, our learning curve was steeper than expected. The situation changed rapidly, with many unknown factors. We learned a great deal after many restructurings.

Filing for bankruptcy protection is a useful tool for distressed companies. It can in many cases also be beneficial for creditors where there is difficulty reaching consensual solutions. Chapter 11 in the US would also give companies global stay to avoid potential lengthy legal battles. A bankruptcy process can be very expensive (often more than $100 million in professional fees), which makes it less attractive for smaller companies.

A company has a certain degree of flexibility regarding where it files for bankruptcy protection. Companies tend to file in debtor-friendly jurisdictions to gain some leverage. There can also be significant differences between jurisdictions in how shareholders are treated.

In many distressed situations, we have seen banks selling out of loans. Buyers are typically hedge funds and distressed debt desks in banks. They have bought “in” at a significant discount to par and often have a different mindset, being more open to converting debt to equity and providing new money if required. Eksfin has on several occasions joined forces with secondary debt holders to improve recovery.

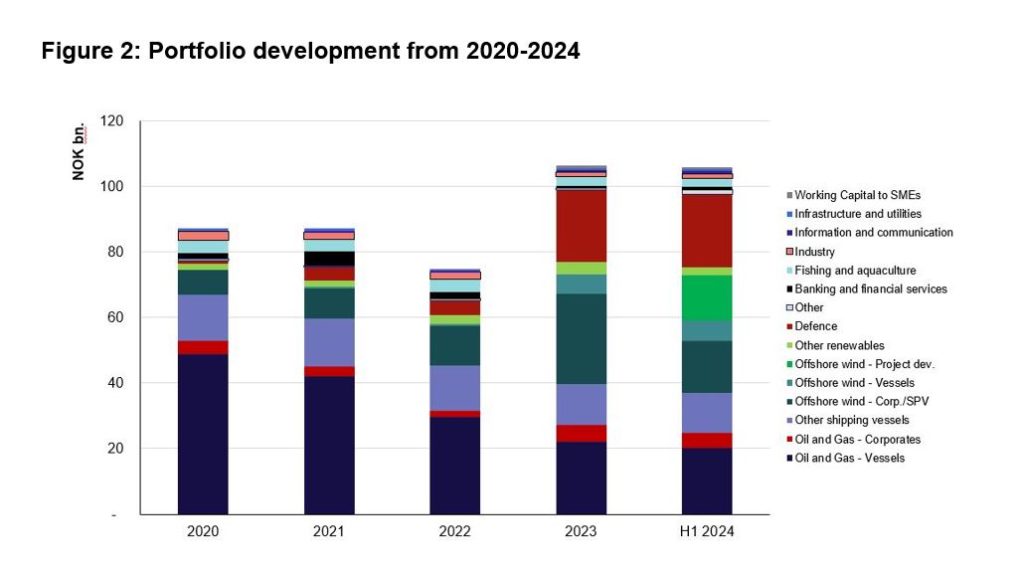

Diversification is key moving forward

Despite Eksfin managing the challenging offshore oil and gas portfolio well, it is unlikely that we will find ourselves in such an extreme situation again. While it remains necessary for Eksfin to continue to accept concentration risk for critical export sectors, we are also keen to manage these risks. In the past few years, we have introduced board-determined limits for industry, transaction, obligor, and country exposures. In addition, we have supplemented our IFRS 9 provisioning with calculations for unexpected loss, to help monitor how new applications will affect the overall credit risk of the portfolio.

Eksfin has also seen a transition in Norwegian industry from offshore oil and gas to offshore wind projects, defence contracts, and aquaculture. New transactions in these areas, coupled with a reduced legacy offshore oil and gas portfolio, have hastened industry diversification and improved overall portfolio credit quality.

Smooth sailing

Eksfin aims to put the lessons we have learned to good use with its credit culture. In addition to concentration limits we have implemented several important measures.

A board-approved credit policy with a clear risk appetite and a detailed credit handbook is now used actively by underwriters and credit team members. There is now regular reporting to both Ministry of Trade and Industry and the Ministry of Finance on portfolio risk and liquidity issues.

We have implemented an organisational focus on accurate expected and unexpected loss calculations, created a specialised legal team for restructuring and defaults, and established a permanent credit committee with restructuring expertise for credits in or nearing default. Information-sharing and lessonslearned seminars are now held on a regular basis for all underwriters, legal, and credit staff.

The situation has drastically improved, but we are continually vigilant, working to keep Eksfin prepared for the unexpected.

This article was first published in the Berne Union Yearbook 2024 by the authors below from Eksfin.

Head of Loan and Guarantee Administration

Senior Adviser Communications and Marketing