Financing for fisheries and aquaculture

Eksfin offers financing to support Norwegian exports and internationalization in aquaculture and fisheries. We provide loans to both Norwegian and foreign buyers, and our guarantee products offer risk relief from the state to banks and companies both in Norway and abroad.

What can we help you find?

About the industry

Fisheries and aquaculture in Norway

The fisheries and aquaculture industry is one of Norway’s leading export industries. In 2023, Norway exported seafood worth NOK 173 billion to more than 150 countries. The seafood industry contributes to value creation and employment along the entire coast and also plays a key role in research, the development of technology, and innovation.

Our solutions

How Eksfin can help your business

We offer a wide range of financing solutions in order to support companies and banks when trading with Norway. In addition to facilitating international buyers, Eksfin can offer loans to Norwegian buyers of ships and maritime equipment.

Buyer financing for purchases from Norway

We offer loans and guarantees to foreign buyers of Norwegian equipment and service deliveries. This includes deliveries to projects across the entire value chain, both on land and at sea.

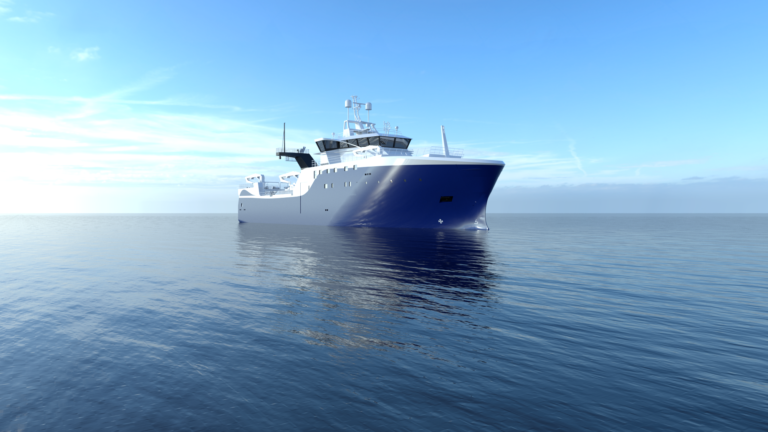

Ship financing for vessels in aquaculture and fisheries

We offer loans and guarantees for various vessels in fisheries and aquaculture. This includes, for example, well boats, slaughter boats, service vessels, and floating sea cages. We finance ships built at Norwegian shipyards, as well as Norwegian equipment and service deliveries for ships built at foreign shipyards.

Bank guarantees ensure that the buyer receives compensation if an exporter fails to meet their obligations. The guarantee is provided by the exporter’s bank, and Eksfin can relieve the bank’s risk. Eksfin can consider all types of guarantees that the bank is willing to provide, as long as they are related to exports. Ask us about guarantees!

Investment financing for export-oriented projects in Norway

Investment financing enables your company to invest in export-oriented operations in Norway. If you are planning to invest in fixed assets, Eksfin can assist with loans and risk relief.

Working capital guarantee for companies that export

Eksfin collaborates with banks to increase access to working capital (overdrafts, etc.) for Norwegian export companies. By relieving 50 percent of the bank’s credit risk, Eksfin enables banks to lend more to companies in a growth phase.

Financing solutions

Trade with Norway

We help Norwegian companies grow internationally. We take on risk and provide financing, so Norwegian companies can compete in global markets.

Contact us

Fisheries and aquaculture specialists

Head of Seafood

Senior Client Executive

Senior Client Executive

Senior Client Executive

Senior Client Executive

Senior Client Executive

Senior Sustainability Adviser

Senior Client Executive

Senior Client Executive

Reference projects

Export success stories

Our solutions

Financing and risk management

Eksfin offers loans to foreign buyers of Norwegian goods and services, and to Norwegian buyers of ships and mobile facilities. Loans are offered at fixed or variable interest rates, and repayment terms and degrees of financing in line with the OECD’s international agreement on publicly funded export credits.

News

News and insights

Meet Eksfin at these upcoming events